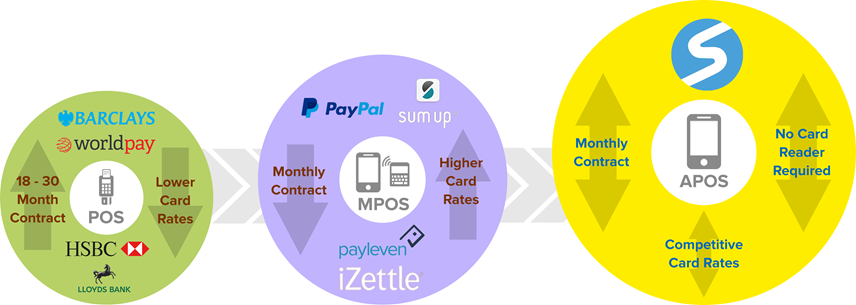

Application Point of Sale (aPOS) is defined as a software or application which performs the same functions as that of a physical cash register or traditional Point of Sale (POS). aPOS differs from Mobile Points of Sale (mPOS) in that it does not require any additional hardware such as a card reader in order to complete a sale. Whereas for aPOS solutions, all you need to do is download an application to your tablet or smartphone. Though mPOS is miles away from POS systems in terms of mobility, it still requires your smartphone or tablet to connect to a payment machine through connections like Bluetooth in order to carry out a sale. Card readers tend to be Chip+PIN, which has historically been a sought after feature as it’s PIN entries have been synonym to security and a waiver of liability to the merchant.

Index:

Are aPOS solutions less secure?

The short answer is no, they are not. aPOS transactions are widely processed as Card not Present (CNP), which is the exact same processing as when you go shopping online. CNP simply means you are not actually present with the merchant at the point of the sale. The reason CNP is becoming more popular is that it opens up a whole new world of speed in transactions, with limitless transaction volume. Contactless payments are processed as Card Present (CP) as you have to be there to tap your card or phone, but as of the moment of writing the upper limit for transactions is £30, which greatly limits what you can sell using contactless. However, with CNP transactions you can theoretically sell a house if you’d want! Though you may not want to pay up 1-2% of £200,000 just for the flexibility.

Another important point to note is that even though we process a transaction as CNP, you are mostly in front of the customer when you take a payment by scanning their card. Thus, you probably have had the chance to meet and greet the customer and made sure it’s not a fraudster paying with stolen cards.

What if I’m not technical, how will I know how to use aPOS?

Believe me, here at SimplyPayMe we know our users have a wide range of tech expertise. The levels range from 0-10 and we serve all of them equally. SimplyPayMe’s app is built with this in mind and therefore, despite a complex feature set, the main functions are intuitive and super simple to use from the application. All you have to do is open it!

Currently, because SimplyPayMe is an aPOS solution, we enable you to take payments face to face, over the phone and through online invoicing, without needing to charge you extra for any of them. Over the course of 2018 we intend to greatly expand our users’ options for accepting payments, so sign up and stay tuned to be the first ever to experience the level of flexibility SimplyPayMe will be able to offer small businesses everywhere.

Have you ever set up a business? A merchant account? Or generally, gone online to research credit or debit card readers? Then you know the term POS (Point Of Sale). POS is a very broad definition of where the sale or customer transaction takes place. This could be the physical location or as specific as what counter the customer checked out from. When card payments were introduced, your only option was to order a large, chunky mobile card reader device. Your customers would swipe their debit or credit card with every sale. But, unless you are Primark, you`re going to need a bit more flexibility in your life. Thus, the payment industry invented mPOS, Mobile Point Of Sale.

mPOS was a way for dynamic businesses who move around to take mobile card reader payments outside of the office, on the go with a small plastic card reader that works with your smartphone. This could be someone selling fast food from a truck, a market stand with antiques, or a plumber fixing a clogged drain in your house. You`d think this solved the problem of efficiency, right? Well… You`d be half right, as mPOS delivers a compromised and not an optimised solution to taking mobile card payments on the go. You’re still relying on unstable connections and clunky card reader hardware.

Introducing APOS, Application Point Of Sale – and I am sure you already know where this is going. We are in 2017, the digital era is upon us and the market place is becoming more and more competitive. It has become easier for anyone to enter markets by the click of a button or the tap of a screen. So, how can you make sure your business is up to date, staying ahead and competing in the area of efficient payment processing and team management?

Don’t be scared to get a smartphone

This may sound strange, but an overwhelming amount of people are worried about buying a smartphone. It’s something they’re not used to, which is completely understandable. Imagine putting a millennial in front of a forest and telling them to “build a house.” It’s about the same thing, putting the older generation in front of a smartphone and saying “run your life/business.” The world is full of teachers and here at SimplyPayMe App we’ll show you the way around the smartphone and APOS. Your smartphone will be turned into the best mobile card reader on the market, just with an app.

If you don’t need the hardware, why take up the space?

As you’ve understood by now, APOS means it’s through application only. SimplyPayMe App is a free app you download to take payments. There is no costly setup, no applications to fill and no merchant account needed. It’s the simple reason for why the cheapest card payment machine out there is your phone.

You wouldn’t like an unstable WiFi connection in your home, so why is it ok for your money?

There are two simple aspects here, the Bluetooth connection and the fact that this needs to work in sync with your internet connection. Bluetooth is limited and often fails, as I’ve experienced when trying to buy a schwarma kebab from my local fast food supplier, time and time again. Not to mention, the reader needs to connect to your phone, and your phone needs to connect to the internet. With SimplyPayMe App, you only need one bar of 3G to take a payment. Why bring in Bluetooth as an extra connection when you don’t need to? It’s kind of like bringing a friend as moral support to your first date. Though it sounds good in theory with good intentions, there won’t be a second one.

SimplyPayMe App can take care of your job delegation and paperwork, a card reader can’t.

Let’s not pretend there isn’t more to a business than accepting payments. You’ll need to actually run it as well. This includes paperless quoting, invoicing and sending receipts, as well as managing your team and delegating jobs. You won’t see a mobile card reader telling your team what jobs are up next. SimplyPayMe App will send them a notification and even their own logins. All you need to do is decide on how much they can access, we’ll take care of the rest.

Why do something in 6 weeks when you can do it in 6 minutes?

For POS card reader systems which need applications, deep screening, merchant accounts and extensive background checks you could end up waiting weeks at a time to take your first payment. APOS and SimplyPayMe App allows you to download an application and take your first customer card payment in a matter of minutes. Anyone who wants to take mobile card payments and increase the efficiency of their business deserves a chance.

Efficiency, efficiency, efficiency…

Less hardware, less connections, less set-up, less costs, less headaches. It’s that simple. You want to take card payments? Download an app. You want your seven employees to be able to take payments? ?dd them as members in the app. You want to send paperless quotes, invoices and receipts to your customers/clients? The app makes it for you. You want to run your team and even entire business from one place? You get the picture.

Summary

There are so many factors which will eliminate physical card readers for small businesses. According to the UK Cards Association, credit and debit card purchases will increase. Don’t lose out on the market because you’re afraid to make the leap into 2017 and the new technology available. Get started with APOS today, the cheapest card reader on the market when factoring in value for money.

I will help you transition to APOS. Feel free to reach out to me at any time on with any questions you may have, none are too small. In fact click here to write me a personal email right away.