“80% of small businesses get through their first year, half of all companies survive more than five years, whilst only a third reach the 10-year mark.”

According to SmallBizGenius.

With statistics such as these, it is no wonder that owning a business is stressful. Knowing that your hard work and dedication are paying off is a big part of the process, but you will first need to sort through the copious amount of business terminology to measure your metrics.

Do not despair – there are easy enough ways to validate your business, and we will show you how through business turnovers.

Turnover is possibly the most important and easy-to-read metric as it indicates a business’s performance. Calculating and understanding a business turnover can help you identify the areas that need improvement, secure investments, value your company and determine its fiscal wellness.

So, when analysing your business’s progress, it is essential to know what business turnover is and how to calculate it. This article defines business turnover, explains the difference between turnover, revenue and profit in business, and demonstrates the best ways to calculate business turnover.

Index:

What is business turnover, and why is it important?

Turnover is a simple metric in business that calculates a company’s performance, indicating whether it is in loss or gain. Knowing your turnover figure enables you to plan and secure investment, measure performance, and evaluate your enterprise if you plan to sell.

In more technical terms: A turnover is the total amount of money your company receives over a specific time, thanks to the sales of goods or services. The calculation does not deduct VAT or discounts; for that reason, it is often referred to as “gross revenue” or “income”.

“82% of SMEs fail due to a neglected turnover.”

By analysing your business turnover over a specific time, you can compare your present turnover to past numbers, gauge increases and match your targets.

N.B. Some definitions of turnover do not refer directly to finance. For example, “turnover” can mean the number of employees that leave a business in a specific period. Or it can also mean “accounts receivable turnover” if you offer credit to customers or clients; this is calculated on the length of time it takes your customers to pay you back.

Why is turnover so important?

As a flat figure, turnover is essential in understanding how to meet your profit goals and court investors; essentially, grow your business or sell your business at the best possible price.

1 – Profit Goals

Analysing turnover in an enterprise determines its financial wellness by forecasting its cash flow. A low turnover implies a business has less available money, which, in turn, affects its operations. For instance, reduce your sales cost by renegotiating contracts with suppliers if your gross profit is low and your turnover is high. Or, if your net profit is low and your turnover high, you should look into ways of making your business financially efficient to meet your target profit.

2 – Investors

In investing, turnover can help a company or individual determine the risk of financing a particular company. Low turnover means a higher investment risk, suggesting that a business inadequately manages its funds. On the contrary, a high turnover points to lower investment risk as the company quickly sells its service or products to customers, indicating a healthy cash flow.

And, how to define turnover in business?

Turnover is the amount invoiced to your customers: the product or service’s cost (minus VAT) + customer’s fees and shipping costs. Ultimately, it refers to the gross income you receive by selling your product or service in a given period – it is calculated before deducting expenses and commissions, and it does not include your costs or any other additional expenses.

What is the difference between turnover, revenue and profit?

The next step is to understand the terms “turnover”, “profit”, and “revenue”, as they are often used interchangeably and, in some contexts, mean the same thing. However, the difference in the business world is significant, and understanding that is crucial:

- Turnover is your total business income during a set time, i.e. the net sales figure.

- Revenue is a company’s income earned by conducting business activity at a price.

- Profit is the earnings left after deducting your expenses.

When citing turnover vs revenue, both can refer to the same thing, for example, when a company earns revenue through sales. Yet, a business can also generate revenue without a turnover and can have a turnover without bringing in revenue. So essentially, revenue is the company’s income generated by its business activities.

As for turnover vs profit, both are vital in determining a company’s financial performance. On the one hand, turnover is the net sales a business generates but does not consider any additional expenses. On the other hand, profit is the leftover earnings of a company’s operations after accounting for all costs and liabilities.

3 Types of turnover in business

Now that the difference between turnover, profit and revenue has been defined, it is valuable to know the three types of business turnover and how they are used to determine a company’s financial well-being.

1 – Accounts receivable turnover

Accounts receivable is the monetary amount customers owe an enterprise for its products or services. The amount owed comes when the customer buys a product or service with credit and doesn’t immediately settle the account. In this instance, companies need to achieve high turnover rates to increase their cash flow and improve operations.

A business aims to maximise customer sales while minimising the receivables balance to improve its turnover rates.

2 – Inventory turnover

Inventory turnover indicates the time in which an enterprise sells its merchandise. The faster a company sells its products to clients, the less physical inventory they store and the higher the turnover rate.

As mentioned, demonstrating a high or low inventory turnover helps investors define the risk level of investing funds in a company. A higher turnover rate can reflect higher profitability, while a low rate can reflect lower profitability.

For example: A turnover rate of 1 or less shows that the company has more merchandise than its current market demand. A turnover rate of over 1 shows that the business sells products that match market demands.

If a turnover rate is too high, the consumer demand might surpass what the enterprise can supply.

3 – Portfolio turnover

Portfolio turnover measures the time it takes for fund managers to sell or buy fund securities over a specific period of time. Investors analyse this rate to determine fees and taxes they might incur with a higher turnover rate. Higher rates are subject to capital gains taxes, which can annul the company’s profit from buying or selling a security. Lower turnover rates can reflect lower profitability but are less likely to sustain capital gains costs.

For example, a portfolio turnover ratio is low at 30% or less. When the turnover ratio is low, the fund manager usually follows a buy-and-hold investment strategy. The fund manager will hold the investment even when the market looks uncertain, hoping that stock value will eventually increase.

A portfolio turnover measures how quickly a company buys or sells fund securities.

A guide to calculating turnover for businesses

The next step is knowing how to calculate turnover in business, which should be straightforward, as long as you keep clear and detailed sales records for a given time.

If you sell products: Your turnover will equal the total number of products sold.

If you sell services: Your turnover equals the total you charge for your services.

Once calculated, you can use these turnover figures to calculate your gross profit (by removing the cost of sold products or services) and net profit (by removing operating costs).

N.B. Remember that turnover alone is not a measure of success; companies will make sales, but the turnover itself indicates size and not success. For this reason, you can only use turnover to dictate success when compared to other factors, such as your company’s costs.

Calculation example of a turnover in business

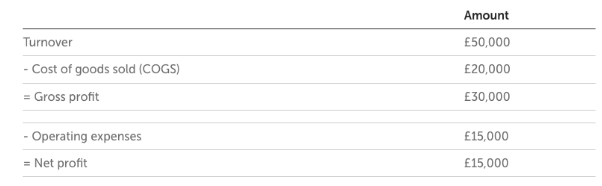

To further understand the previous steps, it is best to visual a turnover calculation through an example:

Firstly, you will need to estimate your gross and net profit to calculate your business turnover. Doing so will clearly indicate whether you are overspending on goods or operational expenses.

For example:

Simple version:

Elaborate version:

Your turnover for this year is £100,000

Last year’s turnover was £80,000, with a gross profit of £70,000 and a net profit of £65,000.

- The turnover is higher than last year’s.

Adding this year’s profits:

Cost of goods sold = £30,000

Operating expenses = £15,000

Gross profit = Turnover – Cost of the Sold Products

£100,000 – £30,000 = £70,000 Gross Profit

Net profit = Gross Profit – Costs

£70,000 – £15,000 = £55,000 Net profit

What does this mean?

According to the above calculation, the gross profit is equal to last year, though the net profit is lower. In other words, operating prices have increased.

Tip: If your net profit is low, you should look into making your business more efficient. For example, start saving on administrative expenses.

However, if the gross profit were lower: the company would need to lessen the costs of sold goods to increase profit.

Tip: If your gross profit is low, you should look into ways to reduce the cost of sales. For example, renegotiate agreements with your suppliers.

Important points to keep in mind

Understand your turnover to determine what you need to achieve in order to reach your target profit.

Businesses use turnover to measure their level of success: as a company grows, expenses should stay lower than the turnover.

Make sure you manage your financial records properly; this should be the case if you calculate your tax returns.

Profit and turnover are significant: there can be no profit without a turnover.

Growth is essential in business; you should be improving your business each year.

Summary

Turnover is a crucial indicator of a business’s performance. Calculating and understanding a business turnover can help you identify the various areas that need improvement, secure investments, value your company and determine its fiscal wellness.

Enterprises should grasp the importance of turnover in business, its meaning, ways to calculate it and most importantly, how to read it to conduct a healthy, growing company. These steps are key in keeping your enterprise afloat whilst maintaining a healthy cash flow as a business owner.

To keep a clear record of your business’s payments, expenses and income, it is highly recommended to use an online platform like SimplePayMe.