“Late payment is the silent killer of modern business”

Anil Stocker, co-founder and CEO, MarketInvoice

Processing overdue payments and outstanding invoices can be uncomfortable, especially when maintaining a good client relationship. And as small businesses, freelancers, and entrepreneurs are usually the last in the work chain; they are often the final ones to be paid. Regrettably, this is an ongoing problem for SMEs.

MarketInvoice discovered that in 2017, 62% of invoices were paid late. The UK averaged 66%, the US 71%, and Europe 73%. The report also found that UK companies pay their employees an average of 18 days late.

Outstanding invoices can be lethal for a business, as they affect cash flow and affect the ability to pay staff, suppliers, rent, and more. Eventually, they can render a business insolvent.

Setting up ways to prevent late invoices and successfully chasing overdue bills are essential skills to master for small businesses.

This article aims to provide solutions to prevent overdue invoices and reduce invoice follow-up stress.

Index

Preventing overdue invoices

As a small business owner or entrepreneur, it is best to eliminate the problem from the start by preventing the situation from happening. To do so, establish rules and regulations right from the start: prevention is always better than cure.

You can easily prevent overdue invoices by following these eight simple steps:

- Enforce explicit payment terms in your contract: When the payment is due, when the payment is overdue, and the consequences. If stated clearly in your business contract, these terms will serve as a deterrent for your customer not paying their invoice.

- Run credit checks on your customers: Before onboarding a new client, ensure your future client is trustworthy; a credit check can provide you with essential information on potential clients to assist your decision.

- Determine late payment penalties in your invoice terms: One way to potentially dissuade clients from paying late is to include fees, or interest, in your payment terms. Even though only stated in your contract, these terms and conditions seem to adhere to your clients, helping prevent unpaid bills.

- Automate payments: Automating overall payments is an alternative way of avoiding late invoices altogether. Direct payment platforms like SimplyPayMe can handle the process for you – from invoices and project management to payment collection.

- Before initiating work, request an upfront payment or deposit: A pre-work deposit will help your customer pay their invoice on time and allow you to get the attention and focus you need from your client to complete their project.

- Invoice immediately after the work has been completed: Invoicing a customer when the job is finished is essential, as “I completed my end of the deal, you complete yours” is still in mind. Moreover, you will gently pass on a message to your client by including a section on statutory late payment interest.

- Schedule polite payment reminder emails: Sending your customers invoice reminders before the billing date is a standard procedure and a gentle nudge for payment. The good news is invoicing software exists that automates the process from start to finish.

- Establish a good relationship with the people handling your client’s invoices: In this case, the person taking care of invoices will be more inclined to pay you and preserve the working relationship; this may be invaluable when chasing payments.

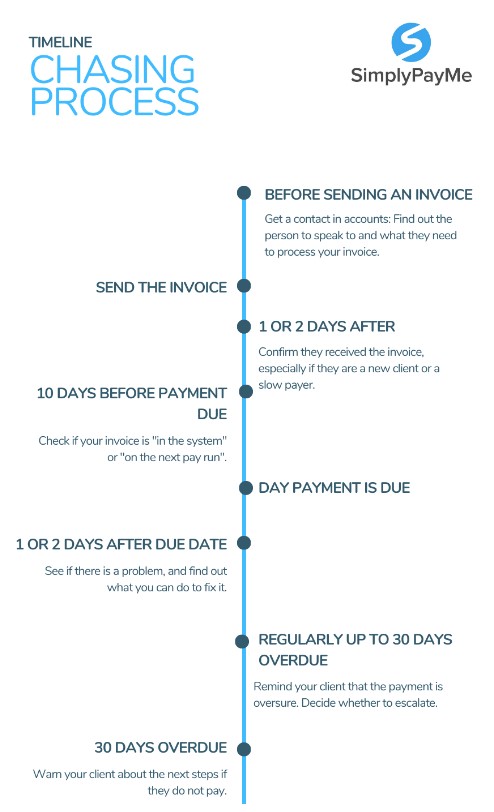

Establish a process for chasing

While it’s crucial to keep healthy relationships with your clients, these won’t last if you are not getting paid. Although chasing a customer for money may be uncomfortable, there are ways to implement the process. Setting up a payment monitoring timetable makes the process more professional and less personal.

54% of businesses said it took too long to receive customer payments, and 45% said their clients didn’t pay on time.

SmallBizzTrends

Depending on your business, you can use a calendar to time your reminders or use automated accounting tools. It is best to schedule your reminders in a precise time frame to soften the chase:

4 Main reasons companies give for unpaid invoices

Your client can give you endless reasons for an unpaid invoice, which can be frustrating, but the fact is, your business will be the one that is largely affected. Here are a few of the reasons why an invoice isn’t paid (on time):

1 – Your company’s approach is too laid back:

As a company, you need to find ways for your client to pay on time to keep your relationship mutual. Some SMEs are passive regarding payments, and many clients take advantage of this. They prefer paying you lastly not to jeopardise their “stricter” business contracts.

2 – Your client is not satisfied with your product or service

One of the biggest reasons clients do not pay an outstanding invoice is their dissatisfaction with the product or service. Efficient products and services lead to satisfied customers, thus creating trust and loyalty and, ultimately, a stronger business relationship and on-time payments.

3 – Your client has cash flow problems

Unfortunately, cash flow is a principal reason for late payments. Your client could be going through some unforeseen changes. In this case, communication is key. Find out why they are struggling financially and possibly offer a payment plan as a friendly gesture.

4 – Your rights are not covered in your contract

The Late Payment of Commercial Debts Law Act 1998 protects businesses from the damaging effects of late payments. This law helps companies claim interest and receive fixed sum compensations if a payment has not been received or if it is late. Some smaller companies may not be aware of the law or are reluctant to use their rights for fear it will harm their business relationship. Although, it is good to know the law can help you without eradicating your business relationships.

Ultimately, when faced with late payment excuses, the important element to keep in mind is that your client “owes you the money“. If a payment deadline has passed, you are entitled to be paid, even if the client’s explanation seems honest.

5 Actions for chasing late invoices

If you still have not been paid – even after enforcing the steps above – it is crucial to stay calm and remember that it could just be a humane mistake.

1. Email, letter or phone

The first measure is to send a friendly reminder by reaching out via email, letter or phone. You should ask your client if they had any issues with the process and request an exact payment date. It is essential to keep records of your correspondence if you have to escalate the process.

2. Use a debt collection agency

A good debt collection company will handle sorting your unpaid invoices thoughtfully, ensuring you won’t risk losing the client. The agents will do the running for you – write letters, make phone calls, and so on.

They do not charge if they fail to collect the outstanding payment, and if they manage to collect the debt, they will charge you between 5% and 15%.

3. Getting solicitors involved

If unfortunately, your client refuses to settle, you may need to hire a solicitor. A debt solicitor is a skilled legal professional who specialises in assisting, advising and taking action to recover money for businesses. They usually charge an hourly rate or take around 10% of the value of the unpaid bill.

4. Money claim online

Online services are a cost-savvy alternative if you are a freelancer, contractor or small business owner and don’t have the funds to hire a third-party agency. For example, the Online Money Claim service sends your client a letter from the court prompting payment. If they don’t pay within a specific time, the court will register a County Court Judgement (CCJ) against your client. However, the process does not guarantee payment, and it will most likely eradicate the relationship you had with your client.

5. Seeking legal advice and mediation:

Seeking legal advice is never pleasant, primarily when directed to an ongoing business relationship. Though, if your business or cash flow is at risk, it may be your last option. This process involves three primary practices depending on your situation:

-

Mediation

The best way to settle any issue is by communicating. The mediation process allows both parties to discuss issues or bring up any problems.

A more peaceful and affordable option than carrying out a legal procedure.

-

Statutory demand

A statutory demand is a formal request for debt payment; the legal letter is the final step before a court case. Once sent, the client has 21 days to respond. However, you can take the client to court if they decide to ignore the letter.

Overlooking a statutory demand carries severe consequences and can result in a company’s liquidation.

-

Court action

If the invoice hasn’t been disputed through the complete process (including your invoice email follow-ups), you can then take court action. You must, however, show proof of communication between you and the client when choosing this legal route.

Court action should be your last option as it is the most time-consuming and most extreme measure.

How long can you chase an unpaid invoice?

You can chase an unpaid invoice for up to 6 years, even under a simple contract. Based on the 1980 Limitations Act, invoices remain valid and must be settled within this time limit. Yet, acknowledgement of the debt can extend this period.

In some cases, clients claim they have never received the work and/or any payment reminders. For this reason, keep accurate records of your actions to drive out late payments. If a collection agency is involved, ensure you have copies of those records.

Maintaining contact with the debtor is crucial: if there has not been contact with your client over the last six years, your client will have reason to dispute the debt.

A few simple steps to reduce invoice follow-up stress

Pursuing outstanding payments can be frustrating, especially if you go down a legal route. Nevertheless, there are ways to spend less time worrying about chasing up invoices and more time adding value to your company.

One simple and highly effective practice to reduce stress is automating your email follow up process. Great invoicing tools exist for this, allowing you to set up and automate emails and choose your timeline whilst the software takes care of the rest.

SimplyPayMe, for example, is a highly valuable platform for this approach, as it processes fully-fledged payments, quotes and invoices, project management and email follow-ups.

Conclusion

Being an entrepreneur is a rewarding lifestyle that many aspire to be. Yet, there is no denying that this position comes with stress and anxiety, both emotionally and financially – more so when you are struggling with unpaid invoices.

Chasing overdue invoices and timely payments are considerably easier if you establish your terms and conditions right from the start. Thus, as an entrepreneur, it is crucial to clearly contract your payment terms and invoicing process when onboarding a new client.

Lastly, remember that humane errors are conceivable, and when a client’s payment is overdue, a friendly invoice reminder is usually all it takes. While legal action could be required, it is doubtful that you will need to take this course of action.

Essentially, preparation from the get-go is fundamental for you to tackle any invoice-related issue.

To learn more about SimplyPayMe’s invoicing tools and automated software, visit our page.