With the growth of Omni-channel experiences, the gap between the physical and virtual world closes, altering consumers’ expectations. Businesses need to understand their customers’ needs as client satisfaction is key to success, and today, consumers want options. One fundamental practice is the ability to provide both online and offline payment methods. By doing so, businesses will increase customer satisfaction, thus retaining new customers.

A study published in Harvard Business Review found that positive experiences generate 140% more customer spending with a company over time.

“Customer Retention is the Key to Success”

Going further, SEMRush (a digital marketing tool and an innovative resource for content strategy) has shown that the probability of selling to an existing customer is between 60% and 70%, the chance of selling to a new customer is only between 5% to 20%.

One of the major playing customer retention factors is providing card payment options. These can be divided into two groups: card-present (CP) transactions and card-not-present (CNP) transactions. This article further explains the meaning and function of CP and CNP transactions, their impact on your business, the potential risk CNP transactions can generate, and 10 ways to prevent them.

Index:

What are card-present (CP) transactions?

More than the simple presence of the physical card, a CP transaction is when electronic information is entered at the time of sale with a point-of-sale (POS) terminal.

A CP transaction can be done by:

- Swiping a magnetic strip card

- Inserting your EMV chip card

- Tapping your card on a POS terminal

- Using a contactless digital wallet (i.e. Apple Pay)

What are card-not-present (CNP) transactions?

Essentially, a CNP transaction happens when neither the cardholder nor the credit card is physically present at the time of the trade. Ultimately, no payment details were captured in person during the sale.

For example:

- There was no swipe of a magnetic stripe

- There was no insertion of an EMV chip

- There was no tap of a mobile wallet

What is the importance of CNP transactions?

As e-commerce purchases become more and more popular – mainly since the COVID-19 pandemic – internet retail sales rose by 72.7% in 2020, with 87% of UK consumers buying online. In the UK e-commerce market alone, the numbers have gone from £1.8 billion in 2000 to a whopping £688.4 billion by the end of 2021.

As proven by these numbers, CNP transactions have become a crucial element in any retail business, today more than ever. Hence it is essential to work with a payment processing company that provides safe and easy ways to operate these card-not-present payments.

Types of CNP transactions

The easiest way to understand the meaning of a CNP transaction and the high value it brings to any retail business is by showcasing its usages.

- Electronic invoices: When an invoice and payment are automatically submitted to customers and paid without the presence of the retailer.

- Automatic billing: Bills or subscriptions are set up for automatic payment.

- MOTO or Mail or phone orders: When a cardholder is not present but submits their card information directly to a company by telephone or email – the card and its holder are usually in one place and the retailer in another.

- Ecommerce purchases: These payments are carried out via online payment gateways at the “check-out” stage of an online shop. The card is physically present with the cardholder, but the retailer is in another location.

- Card on file: Customers use saved card information to make a purchase. Meaning that neither the card, the cardholder nor the merchant is in the same location during the transaction.

- Manual entry transactions: When a merchant manually enters a customer’s card details into a terminal or mobile device.

- Cloud wallet payments: This is a newer type of CNP transaction, where a smartphone app holding the card information is used to make a purchase. This payment method can often mean that both the cardholder and the merchant are physically present during a transaction, but not the card.

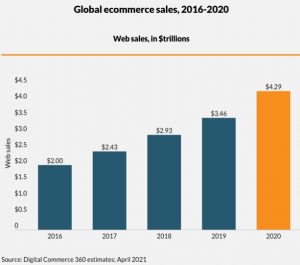

While CNP transactions may seem frightening, most business models require the tool to succeed. With a global rise in online purchases, $3.46 trillion globally in 2019 alone, card-not-present transactions are vital for keeping existing clients and attracting new ones. However, the specific method you choose for your company transactions depends on how you wish to receive your customer’s credit card information.

How much does it cost to process credit cards remotely?

Like a usual credit card payment system, your business will have to process CNP transaction fees, i.e. the fees a merchant pays for each credit or debit card sale. There are three main types of credit card processing fees: 1) Interchange fees 2) Assessment fees 3) The payment provider’s mark-up.

Having a transactional fee taken off each processed payment may seem overwhelming for a small business, but it doesn’t have to cost much. SimplyPayMe, for example, charges from 1.40 % for every transaction made, with no monthly fee

or extra charges per transaction. SPM’s pricing model is significantly lower than other major payment system providers, such as PayPal, Stripe or Square.

Be aware that numerous businesses are paying higher processing fees without knowing, as they manually type in their customer card information into a terminal or mobile device. However, they are still paying CNP rates. If investing in a mobile card reader, these rates can be bypassed and replaced by less expensive CP rates. SimplyPayMe is a great solution for this problem, as they offer secure, low-fee payment options directly from your smartphone, or tablet using a 3G connection.

Do CNP transactions cost more?

The simple answer to this question is yes, card-not-present transactions cost more. Nonetheless, the cost to process credit cards remotely depends on two main factors: 1) The fees set by the payment processor, which can vary as they are determined by them 2) The card type, as the price between a personal debit card and a commercial credit card differs. Commonly, interchange fees are increased for card-not-present transactions, as the possibility of fraud and chargeback is higher without the physical card. Thus, these fees are transmitted to the retailer, resulting in slightly more expensive CNP transactions.

What is CNP fraud?

Card-not-present fraud is when a fraudster uses another person’s credit card information to make a distance purchase. Unfortunately, this is often the case as cardholder information is harder to verify in cardless transactions.

According to a Juniper Research report, “CNP fraud will have retailers lose about $130 billion in cumulative revenue between now and 2023”.

Moreover, with the rise of EMV payments (smart payment via smartphones), there has been a significant decline in CP fraud, with a surge in customer-not-present card payment fraud. In such cases, the business is responsible. Nevertheless, there are numerous ways to make your CNP transactions more secure.

10 Ways to prevent CNP fraud

CNP fraud should be one of your utmost priorities when it comes to your company. Not only to avoid the financial loss associated with fraud but also because excessive payment scams could negatively impact customers’ trust in your business. So, to limit the risk, here are 10 prevention techniques that can help your business:

- Use a secure payment gateway

Make sure your company does not need to collect and retain sensitive card information. Rather, use a trusted corporation specialised in anti-fraud measures. A few popular third-party corporations are ‘Verified by Visa’, ‘SecureCode’ (MasterCard) or ‘SafeKey’ (American Express). - Card Verification Value (CCV)

Also known as the card security code, CCV refers to the three or four digits usually found at the back of your card (or for some cards such as American Express, at the front). The code confirms that the cardholder transacts with an authentic card linked to a bank account. - 3D secure authentication

Most companies use this authentication method to verify the cardholder’s identity whilst making an online purchase. Once the client enters their payment information, they are redirected to their card provider’s 3D secure website. This will ask the card owner to either enter a previously selected password or request a one-time code sent to their phone before finishing their purchase. - Capture important customer information

Be sure to collect sufficient customer information at the time of payment, such as telephone number, e-mail address, billing address and shipping address (especially for high-value transactions). In addition, all card information, such as the cardholder’s name, expiry date, card number and security code. - Maintain PCI Compliance

Whether the card is present or not, all businesses need to be PCI compliant. This is a set of security standards designed to ensure that all businesses accept, process, store or transmit card information in a secure environment. - Use an Address Verification Service (AVS)

This verification system is a practical way to verify a cardholder’s address. The system compares and verifies the credit card provider’s billing address with the address given to the credit card company. For this reason, most payment processors will require the customer to verify their billing address before allowing a CNP payment. - Use Smart Reporting

Smart reporting allows you to identify warning signs and monitor suspicious activities such as frequent returns and chargebacks over time. - Create a culture of security

Regularly provide employee awareness training and install a company culture based on security to protect your business from credit card fraud. - Secure Sockets Layer (SSL)

Secure Sockets Layer is an encryption-based internet security protocol, making information impossible to decrypt if intercepted to protect user privacy. SSL then initiates an authentication process (called ‘handshake’) between two communicating devices, ensuring that both devices are really who they claim to be. - Never store card numbers or security codes

Never keep card numbers or security codes on paper or on any electronic devices as they can easily be stolen by hackers or identity thieves.

Preventing chargebacks

First and foremost, what is a chargeback?

Besides CNP fraud, merchant chargeback fraud is among the most common scams. Chargeback fraud, also known as “friendly fraud”, is when a consumer contests a credit card payment and submits it to their bank for cancellation. The decision then lies with the consumer’s bank, which can choose to side with the customer or the retailer. If the bank sides with the customer, the retailer will have to reimburse the consumer and be charged an additional bank fee. According to a study, global chargeback costs will reach $117.47 billion by 2023.

There are four main reasons for buyers to request a chargeback:

- Merchant error: The company shipped the wrong item, forgot a discount, or a technical mistake.

- Unauthorised payments: Usually a child purchasing a game without their parent’s consent.

- Apparent fraud: A fraudster uses a person’s card details to purchase goods without the original cardholder’s authorisation.

- Friendly fraud: Also known as “chargeback abuse” or “liar buyer”.

Chargebacks cost merchants more than 3.5 times the initial loss, which represents $360 for every $100 they lost in terms of direct fraud costs.

Essentially, card chargebacks are meant to protect consumers from unauthorised transactions, though they can cause damage when dealing with the wrong customers.

How to prevent Chargeback fraud?

Thankfully, there are ways to limit the risk of chargeback fraud activity. Firstly, your company needs to be as transparent as possible. This will help the third party decision-maker once the consumer contests a payment.

- Be as descriptive as possible: Your products or services should be described precisely to ensure customers aren’t disappointed with their purchases.

- Be easy to reach: This is particularly useful with buyer’s remorse. It is essential to have a phone number, live agent or support email for customers indicated on your website.

- Respond as quickly as possible: This adds a lot of value and is part of the overall customer service experience any business should offer.

- Ensure you have full authorisation for an order: To prevent unauthorised chargebacks, the retailer should get permission for each package they ship out from their store or warehouse.

- Wait until shipping before charging: The customer should not be charged until the goods leave the warehouse or provide the services.

- Document all conversations with your customers: This can be used as evidence.

Secondly, chargeback fraud detection tools, i.e. payment gateways, can help you identify high-risk transactions or questionable activities. A payment gateway is a technology retailers use to accept customers’ debit or credit card purchases. These gateways include physical card-reading devices and payment processing portals found in online stores. A few payment gateway examples are PayPal, Stripe, Amazon Pay, 2Checkout, Apple Pay, Square and Authorize.net.

Conclusion

Now more than ever, card-not-present payments have become a standard business tool. While CNP transactions may represent a higher risk for fraud, companies can not bypass this payment alternative. The key to fraud prevention is to be well-equipped and prepared.

To do so, you will need to implement simple steps mentioned in this article: 1) Ensure you have important customer information 2) Maintain PCI Compliance 3) Use a trustworthy payment gateway like SimplyPayMe for seamless CNP payments.

Consequently, you will not only save crucial time and money, but you will also build a trustworthy business by meeting your customer’s needs, resulting in increased customer satisfaction and new customer retention.

To understand what SimplyPayMe can do for you and how we can improve your business through innovative payment systems, visit our page.