Yasmine’s CEO For The Day Experience

Through our “CEO of the day” program, our future leaders can experience what it’s like to lead SimplyPayMe for the day as they step into the shoes of Kent Vorland. We are excited to welcome our new candidate to join the program. Introducing Yasmine Abdu, a Chemical Engineering graduate of University College London, our first […]

How to manage invoices as a small business

A healthy business is often centred around positive cash flow and well organised accounts. But this wouldn’t be possible without efficient invoice management, that keeps on top of both expected incomings and all outgoings. Whilst tedious, processing company invoices is one of the most significant parts of your SME’s cash flow. Any minor act of […]

How to choose a mobile POS system

Countless businesses up and down the country are already benefiting from the versatility and practicality offered by mobile point of sale (mPOS). But what are they and how can you adopt mPOS? In this article, we’ve outlined what mPOS is and how it works, the considerations to make before implementing a mobile point of sale […]

The Ultimate Cashless Payments Guide

No matter which industry your small business operates within, you’ll likely have noticed the growth in popularity of cashless payments. But, if you’re thinking of migrating to a cash-free system yourself, it can be difficult to know where to start. Fortunately, we’ve created the ultimate cashless payments guide, to answer your queries and concerns. In […]

What’s the difference between a cash register and a POS?

Regardless of the industry your business operates within, it’s important to have the right systems in place to efficiently accept payments and track transactions. This means you’ll more-than-likely be choosing between a cash register and POS (point of sale) system. To clarify, every cash register is a POS but not every POS is a cash […]

What is a year-end checklist?

A year-end checklist is a formalised list of jobs you set yourself at the end of the financial, business, or calendar year. We’ve outlined why it’s important to create an end-of-year checklist and the 12 steps sure to give your business a boost. Why create a year-end checklist? Running a small business can mean […]

How to Take Card Payments Over the Phone

As a business, it’s important to think about ways to improve your customers’ transactional experience. One way of achieving this is to accept card payments over the phone. But what exactly does this involve? In this article, we explain how to guarantee each remote payment is made safely and securely, the benefits of accepting card […]

What Are Moto Payments?

Customers are always looking for an improved shopping experience, whether visiting a website or physical store. With this in mind, it’s worth introducing cardless MOTO payments. In this article, we explain what MOTO payments are, how they work, how you can benefit from MOTO transactions, and how to incorporate them into your business model. Index: […]

Five Questions with SimplyPayMe Chairman, Michael Brennan

In late 2020, SimplyPayMe appointed the fantastic, highly sought after Michael Brennan as their new Chairman. A senior corporate finance executive with over 15 years’ experience in capital markets, Michael brings oodles of experience and insight to his new role. Back in November, we caught up with him, to find out what made the man, […]

Q&A with our very first CEO for the Day, Mattia Parati

CEO for the Day is SimplyPayMe’s newest professional program aiming at developing and empowering the youngest generations to become leaders of the future. Today, we want to introduce our very first candidate, Mattia Parati, who will be part of the team starting next week! Full Name: Mattia Parati Date of Birth: 21.04.1997 Place of Birth: […]

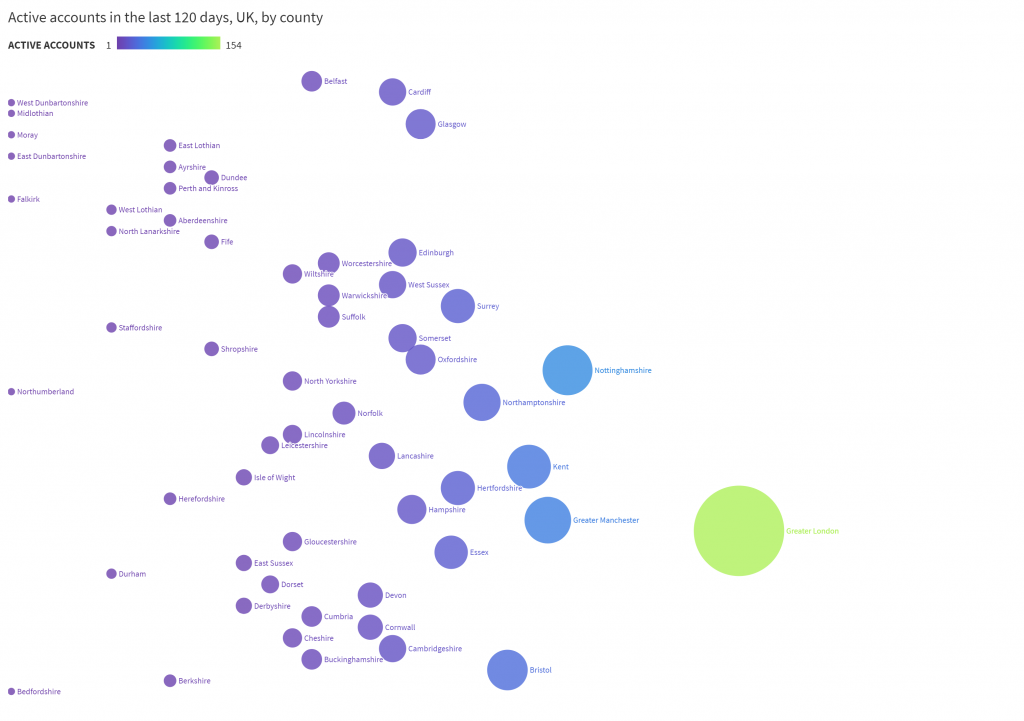

Some interesting Statistics from SimplyPayMe to brighten up your day!

Where are our users located? We thought it would be interesting to have a look into some statistics around SimplyPayMe’s users! We really wanted to see where most of our brilliant users are located, and of course Greater London came up trumps, being #4 Tech hub in the world according to Forbes online. They were […]

How to Avoid Chargebacks For Small Businesses

If you’re running a small business, then you’ll be walking on eggshells most of the time, trying to manage everything perfectly. Therefore, it can be quite disheartening when you find out that a few of your customers have raised credit or debit card dispute and it results in a chargeback. This isn’t something you’d want […]