Frequently Asked Questions

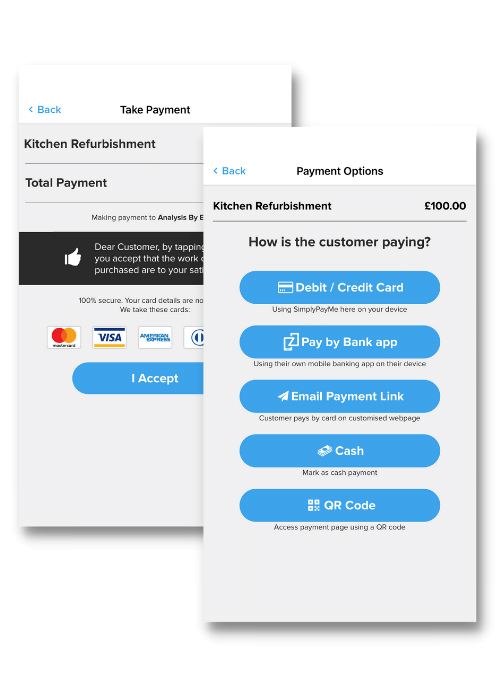

The application is fully “PCI level 1” compliant, meaning it’s 100% secure and holds the highest security achievable in the card industry. While scanning the card, it is impossible to use any screen recording functions on your phone, allowing the safest of transactions.

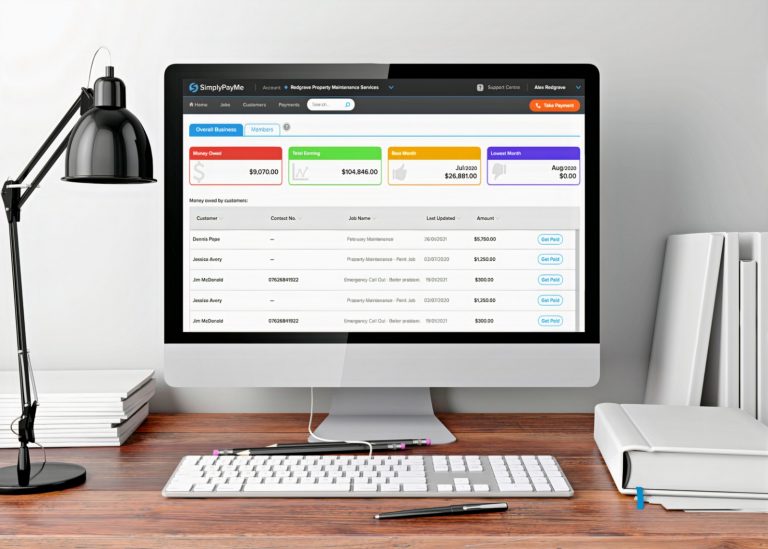

Yes! All businesses – small to large – can accept both virtual and physical cards thanks to its high-functioning scanner which picks up credit or debit card details.

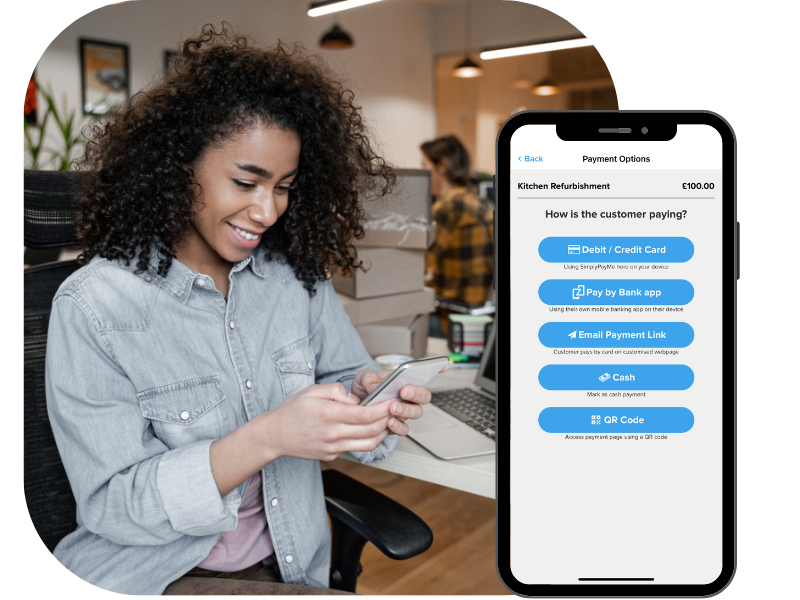

Yes, there is – Receive fast and safe contactless payments with a click of a button with SimplyPayMe’s mobile application. Our no hardware technology allows card, cash, Paylinks, QR Code and Pay by Bank app payments.

Yes, as a Sole Trader you can take payments with a personal bank account. However, you will need to first sign up and create your free business account with SimplyPayMe.

SimplyPayMe’s App allows all card payments, including Visa, MasterCard, Discover Global Network & Amex.