Frequently Asked Questions

SimplyPayMe offers exceptionally competitive prices, with the US charging 2.90% + 30 cents per transaction and from 1.40% on DNA Payments in the UK.

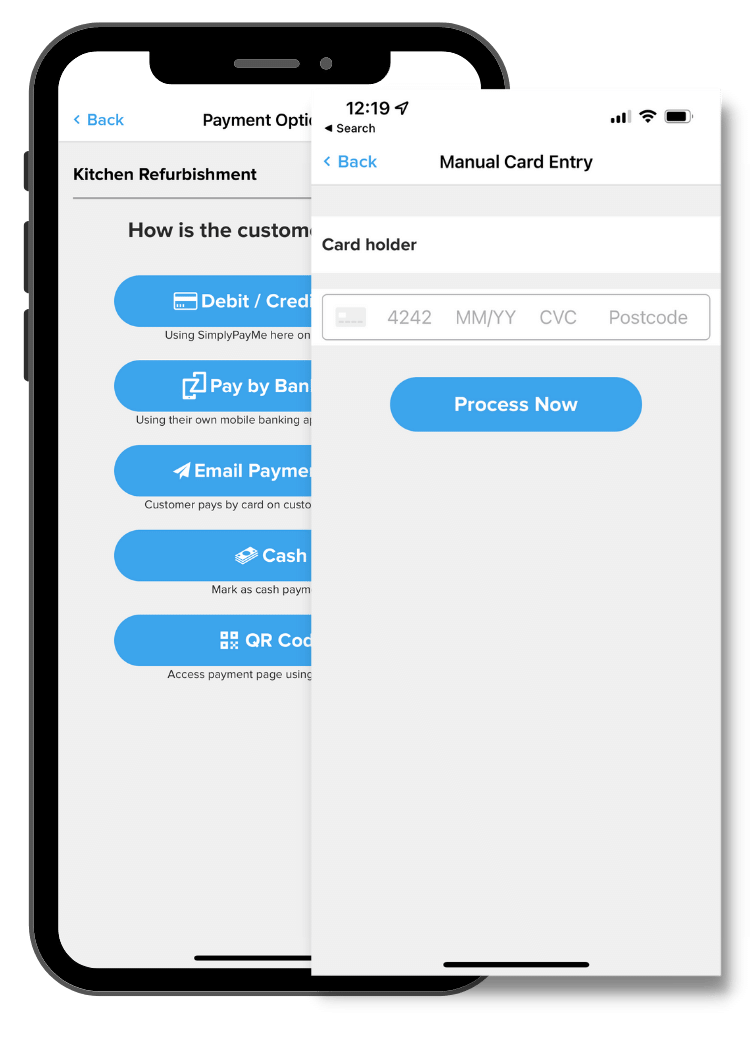

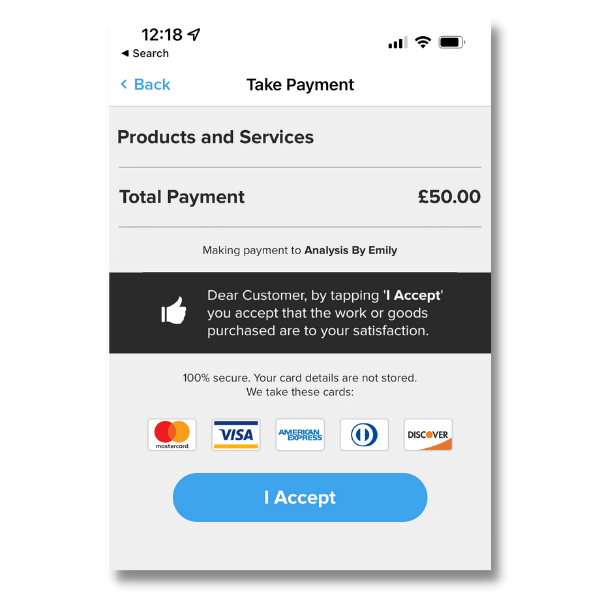

SimplyPayMe accepts all types of contactless payments through plastic or virtual equivalents, which include Visa, Mastercard and American Express.

Contactless payments are a safer and more secure payment solution. Payments will have a transaction amount limit to prevent cards from being used to make large fraudulent purchases.

No, there is no need for POS hardware or complex logistics as our system is 100% cloud-based. With a fully software-based alternative to traditional payment terminals, all you need is your smartphone and our mobile application.